NO. OF UNIVERSITIES

2

ELIGIBILITY

GRADUATE

DURATION

2 - 4 YEARS

ONLINE MBA In Banking and Insurance

An online MBA in Banking and Insurance is a comprehensive program designed to provide students with a deep understanding of both financial sectors. This dual specialization offers a unique blend of courses covering essential aspects of banking, such as financial management, risk analysis, and regulatory frameworks, alongside insurance-related subjects like underwriting, claims management, and risk assessment. The program typically combines traditional MBA coursework with specialized modules tailored to the nuances of banking and insurance industries.

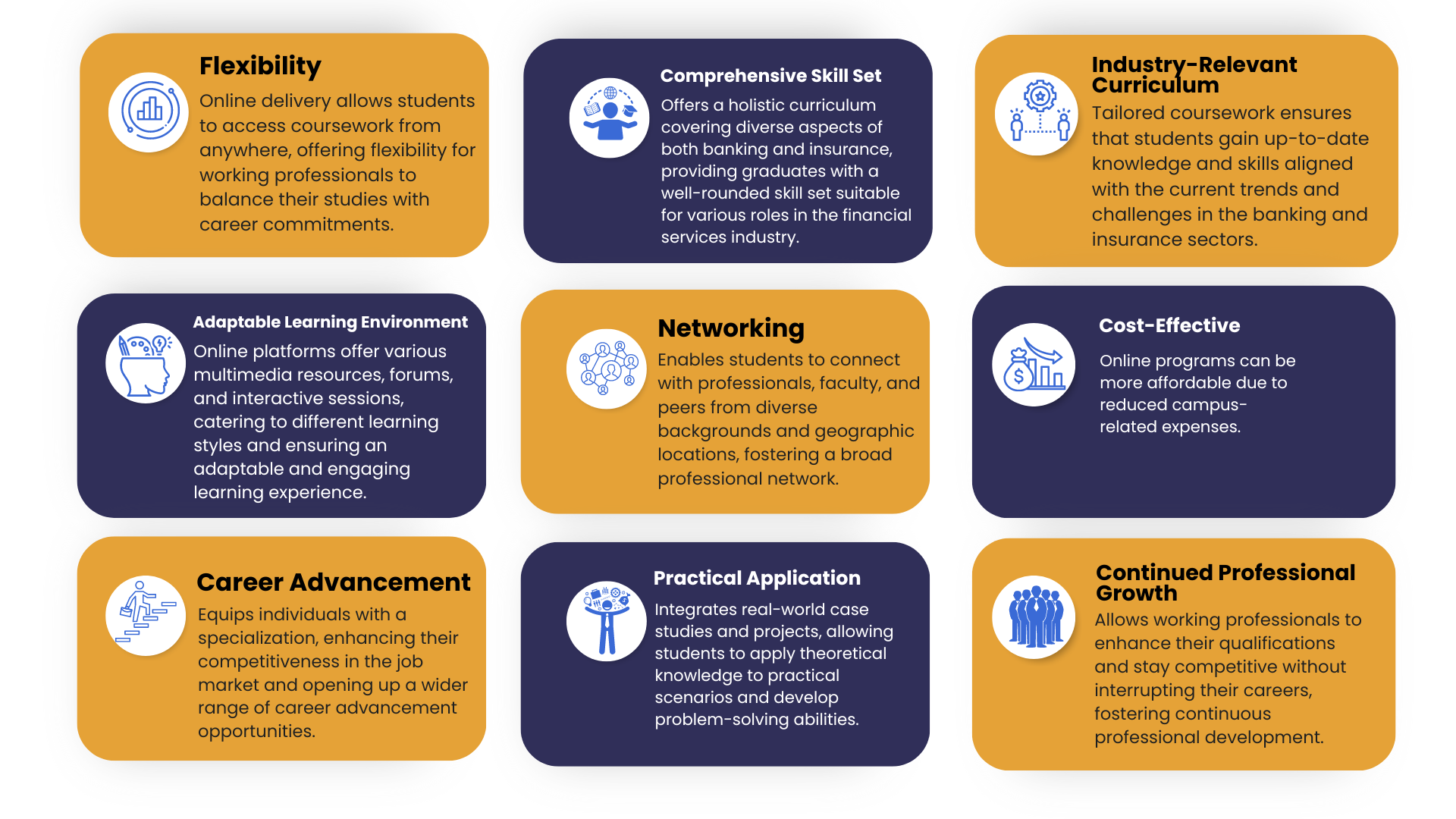

BENEFITS OF PURSUING ONLINE MBA IN BANKING AND INSURANCE

Pursuing an online MBA in Banking and Insurance offers several benefits, including:

• Flexibility: Online programs allow you to study at your own pace and schedule, making it easier to balance your education with work and personal commitments.

• Career Advancement: An MBA in Banking and Insurance can open up opportunities for higher-level positions in the financial sector, such as insurance management, risk management, underwriting, and financial planning.

• Skill Development: The program covers a wide range of topics, including insurance principles, risk assessment, financial analysis, investment strategies, and banking regulations, helping you develop a comprehensive skill set.

• Networking Opportunities: Many online MBA programs provide opportunities to connect with industry professionals, alumni, and fellow students, which can be valuable for career growth and opportunities.

• Cost-Effectiveness: Online programs often have lower tuition fees compared to traditional on-campus programs, and you can save on commuting and accommodation costs.

• Specialization: Some online MBA programs offer specializations in specific areas of banking and insurance, allowing you to tailor your education to your career goals.

• Access to Resources: Online students typically have access to a wide range of digital resources, including libraries, databases, and financial tools, which can enhance your learning experience.

• Improved Time Management: Balancing online studies with other responsibilities can improve your time management skills, which are crucial in the fast-paced world of banking and insurance.

In summary, an online MBA in Banking and Insurance offers a well-rounded education, preparing graduates for diverse career opportunities with a deep understanding of both financial sectors. The scope includes roles in risk management, leadership positions, and the ability to contribute strategically to the growth of banking and insurance industries.

ONLINE MBA ELIGIBILITY

Individuals who have successfully completed their undergraduate degree in any field are eligible to apply for an Online MBA program. Admission requirements may vary among universities. Some institutions require aspirants to pass entrance exams, while others offer direct admissions based on their eligibility criteria.

An Online MBA in has a broad eligibility scope, making it accessible to a diverse range of students. Prospective candidates must hold a bachelor's degree with a minimum aggregate of 45% to 50% from a recognized university.

WHO SHOULD DO ONLINE MBA IN BANKING AND INSURANCE

An online MBA in Banking and Insurance is suitable for:

- Working Professionals: Individuals already working in the banking, insurance, or related sectors who want to advance their careers without taking a break from their jobs.

- Career Changers: People looking to switch their career to the banking and insurance industry from a different field.

- Entrepreneurs: Business owners or aspiring entrepreneurs who want to gain a deeper understanding of financial management, insurance products, and risk management to better manage their businesses.

- Recent Graduates: Graduates with a bachelor's degree in business, economics, finance, insurance, or a related field who want to specialize further in banking and insurance.

- Insurance Professionals: Those currently working in the insurance industry who want to enhance their knowledge in banking and financial services to broaden their career opportunities.

- Aspiring Leaders: Individuals aiming for leadership or managerial roles in the banking and insurance sector and seeking to enhance their leadership skills and industry knowledge.

- Risk Management Enthusiasts: Those interested in the field of risk management and looking to acquire specialized knowledge in assessing and managing risks in banking and insurance.

- Global Professionals: Individuals who wish to gain a global perspective on banking and insurance and work in international finance or multinational insurance companies.

It's important for prospective students to assess their career goals, current professional situation, and personal commitments to determine if an online MBA in Banking and Insurance aligns with their objectives.

ONLINE MBA DURATION

The Online MBA program offers a minimum completion time of 2 years and allows a maximum of 4 years for candidates to fulfill all the degree requirements. This extended timeframe provides an additional 2 years for successfully passing all the required exams. The program's curriculum is structured into four semesters, each spanning a duration of 6 months.

NEED ASSISTANCE?

GET IN TOUCH

Enquire Now

Don’t hesitate to contact us for more information

- Your personal Information is secure with us

By clicking, you affirm that you have read the Terms & Conditions and the Privacy Policy and agree to use Skill2Work’s services in accordance with the same.

Most Common Job Opportunities

| Risk Manager: | Financial Analyst: | Banking Relationship Manager: |

|---|---|---|

| Assess and mitigate financial risks in both banking and insurance sectors, ensuring compliance with regulations and implementing risk management strategies. | Analyze financial data, trends, and market conditions to provide insights for decision-making in banking and insurance operations. | Cultivate and manage relationships with banking clients, offering financial products and services tailored to their needs. |

| Insurance Underwriter: | Investment Analyst: | Branch Manager: |

| Evaluate insurance applications, determine coverage, and assess risks to establish appropriate insurance premiums. | Conduct research and analysis to guide investment decisions, managing portfolios for individuals or organizations in the financial services industry. | Oversee the daily operations of a bank branch, ensuring efficient customer service, compliance, and overall branch performance. |

| Insurance Claims Manager: | Corporate Finance Manager: | Product Manager (Banking and Insurance): |

| Manage the insurance claims process, ensuring timely and fair settlements while adhering to policy terms and regulations. | Make strategic financial decisions for corporations, involving aspects of both banking and insurance to optimize financial performance. | Develop and manage financial products, adapting to market trends and customer needs in both the banking and insurance sectors. |

ONLINE MBA SPECIALIZATIONS

Online MBA > Specializations

ONLINE DUAL MBA

Online Dual MBA > Specializations

How Skill2Work

Assist You?

-

Admission Support services

Admission Support services -

Timely Update & Notifications

Timely Update & Notifications -

Student Support

Student Support -

One - on - One Counselling

One - on - One Counselling -

Career Assistance

Career Assistance

Still Confused?

Get Our Expert Guidance Now!

Top Hiring Firms

Let's Clear Up Some Doubts

MBA in Banking and Insurance

Yes, Degrees obtained through Online or Distance mode are valid provided approval is given by the UGC-DEB to the University/Deemed to be University to offer the said programme. Details of the Universities/ Deemed to be Universities empowered to offer courses under Online/distance mode are available at UGC website https://deb.ugc.ac.in/.

For more information call us!

Yes, UGC via its notification dated 02-09-2022 has clearly mentioned that any degree received via Online or Distance mode is equivalent to the degrees offered through regular mode. The link for the same is

. Accordingly, we can be sure that a MBA done via Online or Distance mode is as good as a regular MBA

The Accreditations or Approvals required by Indian Universities to start Online and distance learning programmes are: -

• University Grants Commission (UGC) Approval: Indian universities, whether traditional or open, need to obtain approval from the UGC to offer online courses. The UGC had issued specific regulations for open and distance learning, which also apply to online education. These regulations specified the norms and standards that institutions had to adhere to while offering online programs.

• Compliance with Distance Education Regulations: In addition to UGC regulations, universities offering online programs also had to comply with the Distance Education Bureau (DEB) regulations, which governed open and distance learning programs.

• Approval from AICTE: The AICTE primarily focuses on technical education, including engineering, management, pharmacy or applied sciences and Indian Universities specifically do not require AICTE approval to start online courses. Its role is to regulate and promote technical education in India. These regulations are mainly applied to traditional universities and institutions that offer online or distance education programs.

• Quality Assurance: Indian universities are required to maintain the quality and standards of education in online programs. This often involves regular assessment and accreditation by bodies like the National Board of Accreditation (NBA) or the National Assessment and Accreditation Council (NAAC).

• Rankings: The National Institutional Ranking Framework (NIRF) is a ranking system for higher education institutions in India. It was launched by the Ministry of Education in 2015 to assess and rank Indian universities and colleges based on various parameters. NIRF rankings aim to provide prospective students and other stakeholders with valuable information about the quality and performance of educational institutions

An MBA in Banking and Insurance is an ideal choice for individuals seeking to establish a successful career in the financial services industry with a focus on both banking and insurance sectors. This program is particularly well-suited for professionals already working in finance who aim to enhance their expertise and advance into managerial or leadership roles within banks, insurance companies, or related financial institutions. Additionally, it caters to career changers looking to enter the dynamic field of financial services, offering a comprehensive understanding of banking operations, risk management, and insurance practices. Aspiring managers and leaders who desire a multifaceted skill set to navigate the complexities of modern financial markets would also benefit from the program. The MBA in Banking and Insurance is designed to provide a strategic and practical foundation for individuals aiming to excel in roles that require a deep understanding of financial management, risk assessment, and customer relationship management in the context of both banking and insurance..

On average, entry-level positions for MBA graduates in this field might offer salaries ranging from INR 6 to 10 lakhs per annum. However, with experience and expertise, professionals in managerial or leadership roles could command significantly higher salaries, potentially exceeding INR 15 lakhs per annum or more. It's essential for individuals to consider the reputation of the educational institution, their own work experience, and the specific job role when evaluating salary expectations in the banking and insurance sector.

Yes, an MBA in Banking and Insurance is a good career option, offering diverse opportunities in financial institutions, insurance companies, and related sectors. It equips individuals with the skills and knowledge necessary for leadership roles and provides a solid foundation for navigating the complexities of the financial services industry.

The scope of MBA in Banking and Insurance includes diverse career opportunities in financial institutions, insurance companies, and related sectors. Graduates can pursue roles such as risk managers, financial analysts, underwriters, and branch managers, with opportunities for leadership positions and specialization in various areas within the banking and insurance industry.

The program's standard duration is 2 years, with students having the flexibility to complete it within a maximum timeframe of 4 years.

No, the majority of universities offering an online MBA in Banking and Insurance typically do not require entrance examinations for admission. Instead, admissions are directly based on the eligibility criteria established by the respective university.

Online & Distance PG Courses

Diploma

Online & Distance UG Courses

Certificate

About Us

Skill2Work is India’s best education provider with an aim to bring transparency in the field of distance and online education in India.

Copyright © 2026 Skill2Work All Rights Reserved | Proudly Powered by ShubhiTech®